US Momentum Report - 8 Dec 2024

Top momentum stocks from S&P100 S&P500 NDX100 Russell 1000 indices

General Market Overview

S&P500

Last Week (1 Dec): Most likely the optimism might continue to take the market even higher.

This Week (8 Dec):

Index made a new all time high

The index looks really strong, and we may see the index push even due to the general optimism that is there in the market.

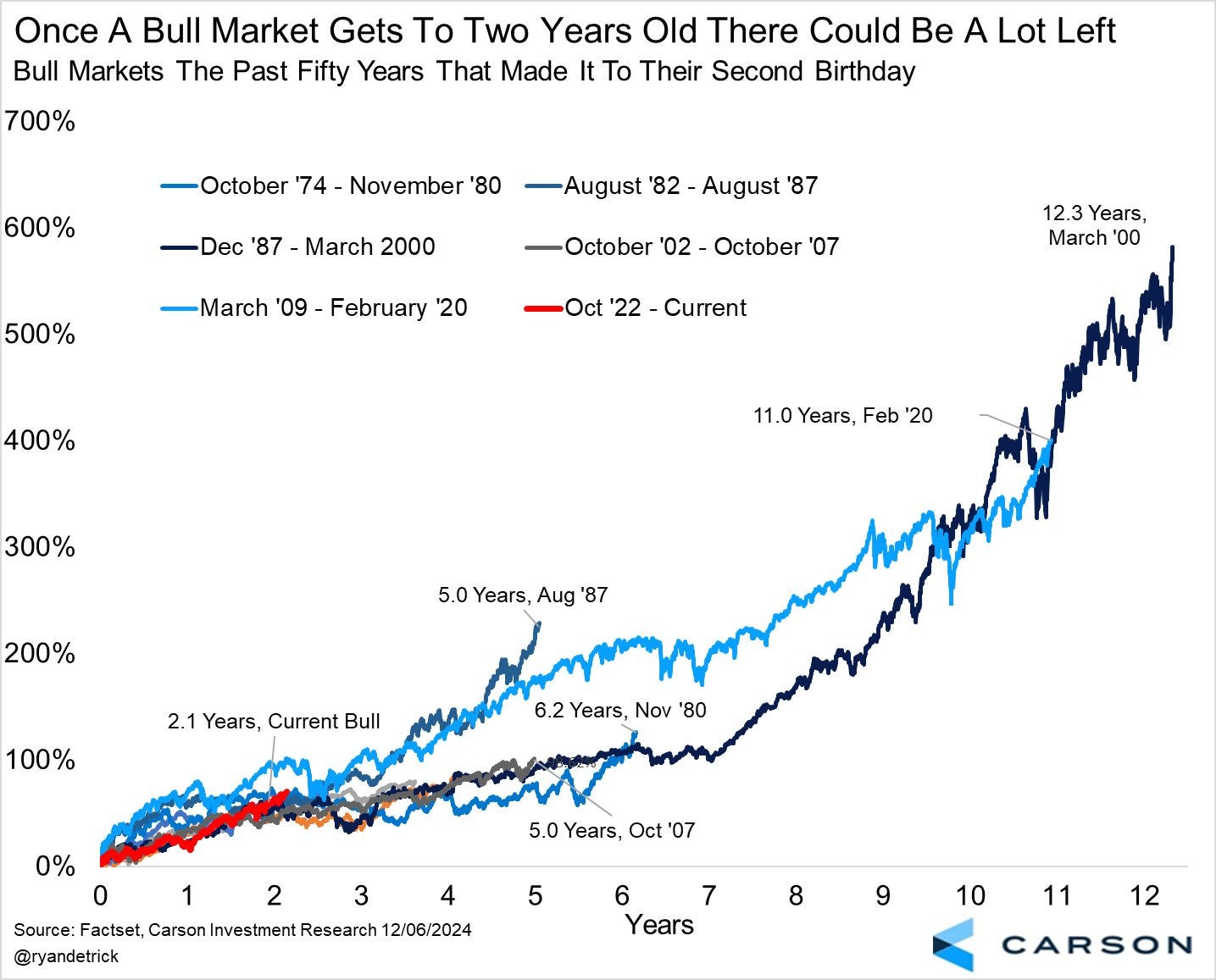

Bull is young (interesting observation from Ryan Detrick).

In general, I’m not a big fan of predicting the market, more of a listener to the market.

Currently the market is telling us that it is very strong, and market participants are optimistic in general.

image source: x/ryandetrick

NASDAQ 100

Last week: It doesn’t appear as strong as S&P500 in terms of scaling new highs. But, don’t let that misguide you. I expect NASDAQ 100 to do way better in the coming months.

This Week:

NASDAQ 100’s move was stronger than S&P500.

Rose by more than 3.31% this week

Top 10 Momentum stocks (6 months price momo)

S&P100

Rank Ticker

1 $TSLA

2 $CRM

3 $PYPL

4 $BMY

5 $GILD

6 $WMT

7 $CHTR

8 $IBM

9 $BK

10 $NFLX

S&P500

1 $PLTR

2 $AXON

3 $TSLA

4 $UAL

5 $VST

6 $RCL

7 $CCL

8 $FICO

9 $PAYC

10 $NCLH

NASDAQ 100

Rank Ticker

1 $APP

2 $TSLA

3 $TEAM

4 $FTNT

5 $DASH

6 $MRVL

7 $MDB

8 $PYPL

9 $WBD

10 $DDOG

Russell 1000

Rank Ticker

1 $APP

2 $PLTR

3 $MSTR

4 $SOFI

5 $UI

6 $AFRM

7 $AXON

8 $CVNA

9 $LLYVA

10 TWLO 0.00%↑

Stocks to watch

General Observation:

Big Tech companies like META, Netflix, ServiceNow, Amazon are continuing to march forward.

Smaller one in Tech/Cloud/Cybersecurity are also scaling new highs.

Banking/Financial lending companies are also doing well.

Focus should be on Tech/Growth only.

Tesla

Taking out short term resistances and coming to face a major resistance/all time high near 415.

If 415 gets taken out, it’s blue sky above.

IMO the real price action will start when we cross 415.

Weekly chart to reduce noise.

FTNT

Consolidating on daily timeframe and wants to push higher. Forming an ascending triangle pattern.

DASH

Consolidating just like FTNT.

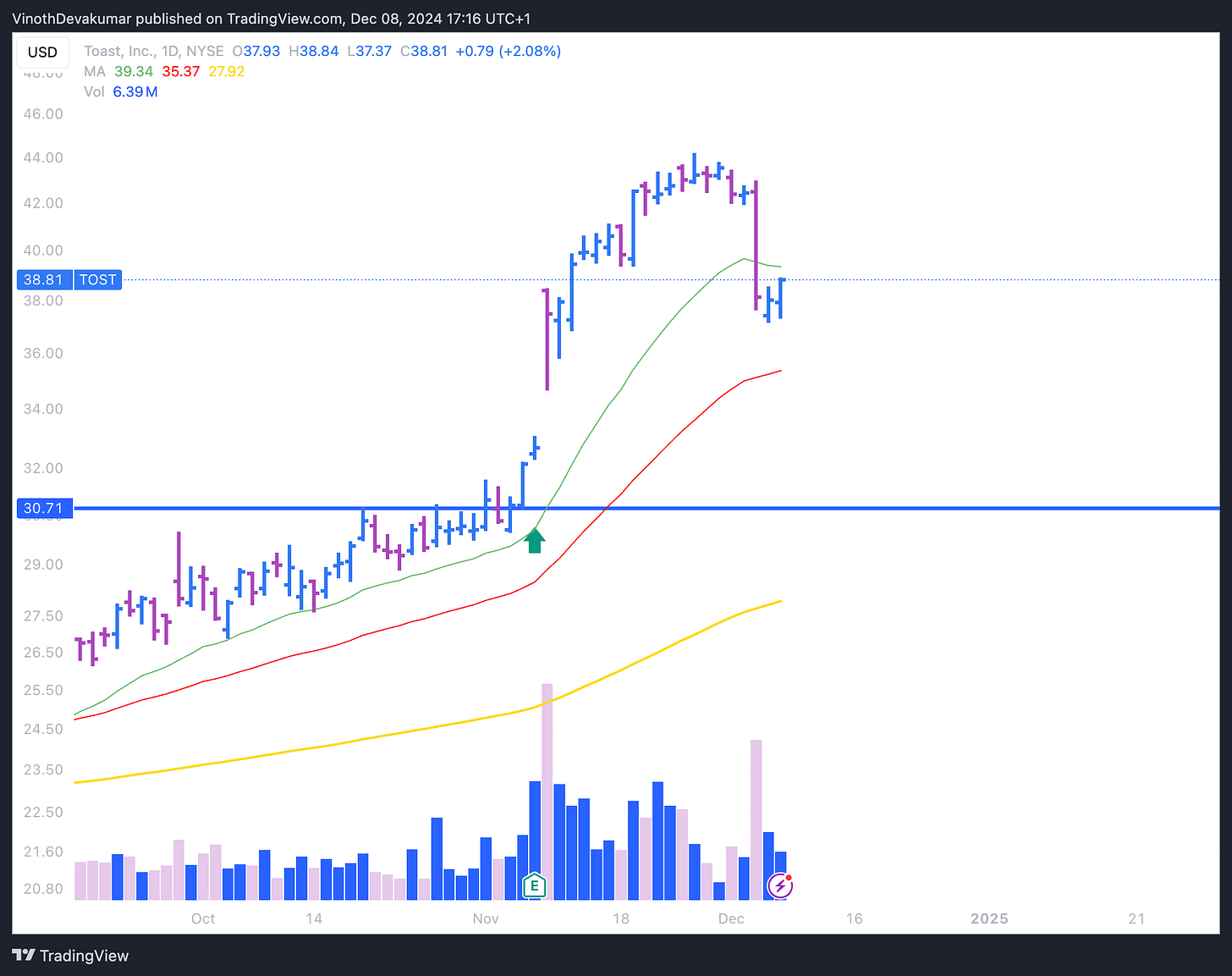

TOST

Toast is presenting an opportunity for those who like pullback setups.

PYPL

Bouncing up from the 21 EMA, which is a good sign. Crossed a resistance at 88, next major resistance is at 92.5

If 92 gets taken out we could be in 3 figures land very soon.

INOD

After the earnings gap up, it is having a couple of weeks of tight consolidation/inside days within the 36-44 range.

If we cross 44, the price momentum could resume and take the stock price to newer highs.

META

Meta might have started the next leg of the upmove.

After the breakout in Sep 2024, it has been moving sideways and is now trying to push higher.

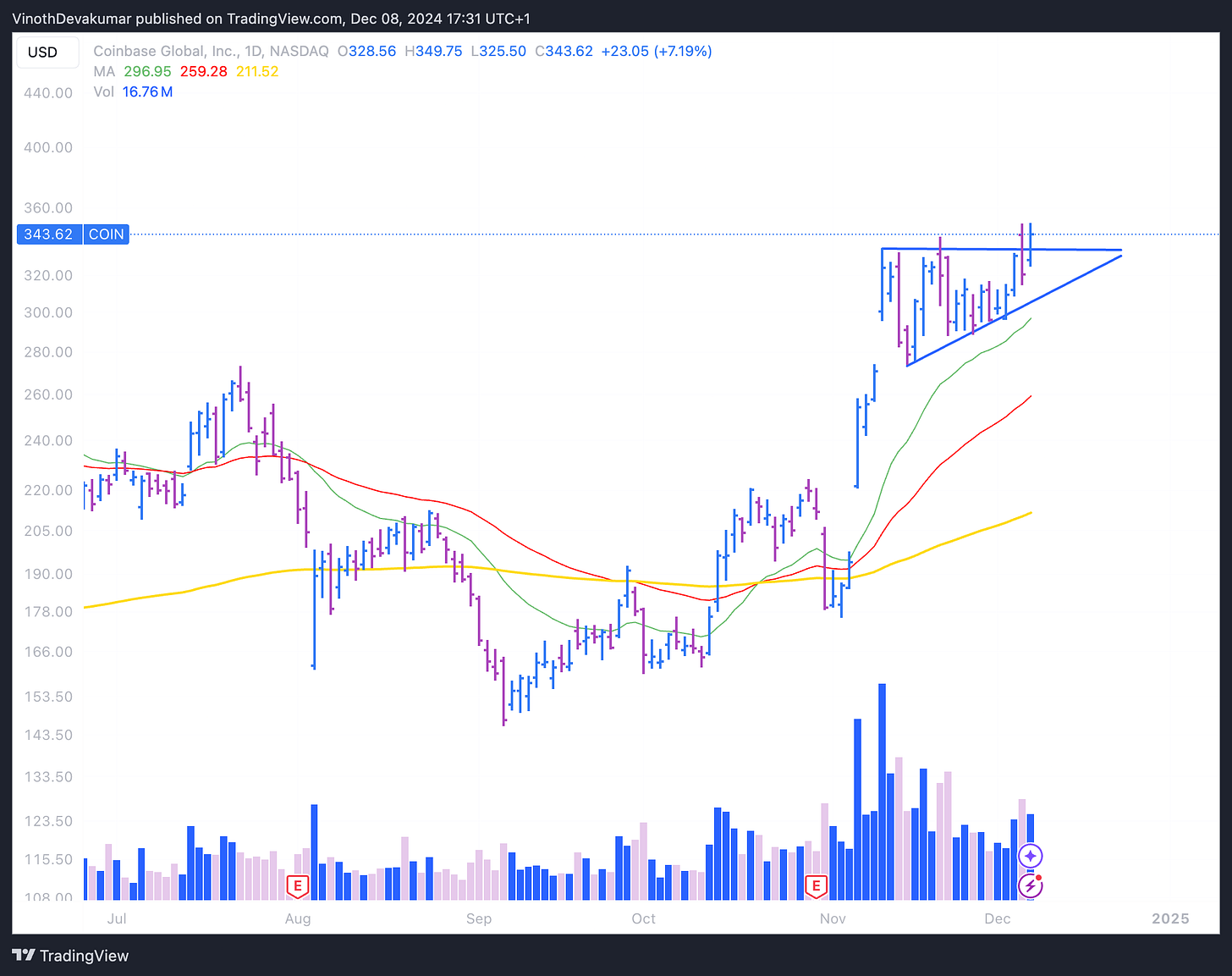

COIN

Coin is forming an ascending triangle pattern.

HOOD

After spending a few days consolidating, HOOD pushed higher.

Also watch RBLX, RBRK, GITLAB, ASANA